Evan’s Ultimate Amex EveryDay Bonus Calculator

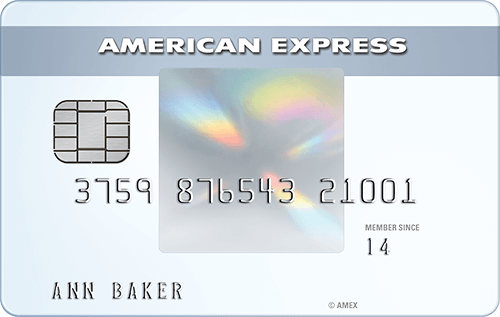

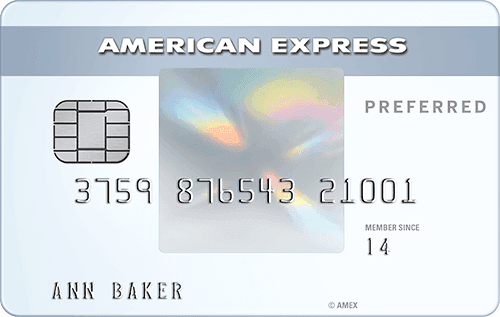

The American Express EveryDay cards award bonus points for using the credit card a certain number of times per month.

The calculator below uses a Poisson model to estimate the expected value of the bonus for both the EveryDay card and the EveryDay Preferred card.

The model assumes you randomly use the card throughout the month, without specifically trying to earn the bonus.

See what your normal spending habits will earn you!

Summary of Benefits

|

$0 annual fee

|

$95 annual fee

|

| 2X supermarkets ($6,000/yr limit) |

3X supermarkets ($6,000/yr limit) |

| 1X gas stations | 2X gas stations |

| 1X other purchases | 1X other purchases |

| 20% EveryDay Bonus for 20 purchases/mo |

50% EveryDay Bonus for 30 purchases/mo |

|

$0 expected bonus 0% of months |

$0 expected bonus 0% of months |

| $0 total value | $0 total value |

Redeem points for:

Budget Analysis

Monthly transaction count:

(on average)

Monthly grocery spend:

(NOT Costco, Target, or Walmart)

Monthly gasoline spend:

(at actual gas stations)

Monthly total spend:

(include gas and groceries)

Neither of these credit cards Learn more

Frequently Asked Questions

What the heck is a Poisson model?

If you make 20 purchases per month on average, that doesn’t mean you make exactly 20 purchases every single month. Sometimes you’ll make 19 purchases, sometimes 23 purchases, sometimes 15.

A Poisson model is a probability model that assumes your purchases occur at random throughout the year, and describes your chances of making a certain number of purchases in a given month.

So this calculator can predict how often I’ll get the EveryDay bonus?

Probably! It assumes your purchases occur at random. If your purchases tend to be concentrated, for example around Christmas, it might get the prediction wrong. Also, if you make a specific effort to hit the bonus every month, the prediction won’t be very accurate.

In the table, what exactly does “expected bonus” mean?

The expected bonus is the expected value of all bonuses received throughout the year. It’s the same as the average annual bonus value you would receive from the card over a long period of time. You’ll notice that the expected bonus is larger when the probability of receiving a bonus is larger, and smaller when the probability of receiving a bonus is smaller.

Why is the “total value” higher if I redeem for flights instead of cash?

Both cards earn American Express Membership Rewards Points. One thousand Membership Rewards Points can be redeemed for $6 cash, or $10 worth of travel.

The total value is measured as the redeemed value of the expected Membership Rewards points (including bonus points), minus the annual fee.

Why does the grocery slider stop working once it hits $500?

The EveryDay cards award extra points for grocery purchases, but only on the first $6,000 of grocery purchases per year. $6,000 divided by 12 months works out to $500/month.

What does the word “Poisson” mean?

It’s French for fish! But it’s also the name of a mathematician who studied the theory of random events. Of course, some people say the Poisson distribution should be named after de Moivre, who first discovered it.

Where can I learn more about the equations behind the calculator?

I’m glad you asked! I’ve written up the mathematical details here: The Amex EveryDay Bonus: A Stochastic Valuation Model

Where can I learn more about these credit cards?

American Express has their own comparison tool, but I think this one is better :-)

© 2019-2020 Evan Miller. Some links may result in commissions being paid to this website.

More calculators: